Regional Property Market Update Autumn 2025: Essex, Norfolk and Suffolk

2025 has been a year of steady momentum, with firm foundations supporting stability in the housing market. Prices remain steady, with modest but consistent gains expected through the year. Sustained summer demand has underpinned momentum, though price sensitivity, softer economic conditions, and policy uncertainty may temper growth.

Outlook and inflation

The Bank of England has cut interest rates to 4%, the lowest level in over two years. Rates have now fallen five times since last August, boosting buyer and seller confidence, though a split vote at the latest meeting has clouded prospects for another cut previously expected in December 2025. Further reductions are anticipated, but the pace remains uncertain particularly given persistent inflation. Inflation remains above target, rising 3.8% in the 12 months to July 2025, driven particularly by higher air fares and food costs¹. The Bank of England expects inflation to peak at 4% in September before easing gradually to its 2% target in 2027.

Mortgage rates edge down

Following August’s bank rate cut, mortgage rates have eased. The average two-year fixed deal is now 4.25%, down from 4.99% a year ago, while the five-year fixed sits at 4.18%, down from 4.49%². Swap rates, which guide fixed-rate mortgage pricing, dipped ahead of the August meeting on expectations of cuts, fuelling competition in the mortgage market, with some deals as low as 3.7%. Mortgage rates are moving in line with the Bank’s cuts, but a significant drop looks unlikely. Hundreds of thousands of borrowers are due to re-mortgage this year, with 900,000 fixed-rate deals expiring in the second half of 2025³.

Robust activity

September marks the beginning of the busy autumn selling season, and despite the usual seasonal lull, demand over summer has remained firm, supported by easing rates and wider choice, with buyer demand up 4% year-on-year⁴. Mortgage approvals rose for the third month in a row, reaching 65,352 in July, 4.6% higher than last year². Residential property transactions also gained momentum, with 95,580 in July, up 4.3% year-on-year and 5% above the five-year average⁵. While economic policy may temper these seasonal trends, realistic pricing is crucial, and the overall outlook for the housing market remains remarkably steady.

¹ ONS, ² Bank of England, ³ UK Finance, ⁴ Zoopla, ⁵ HMRC

Prices in balance

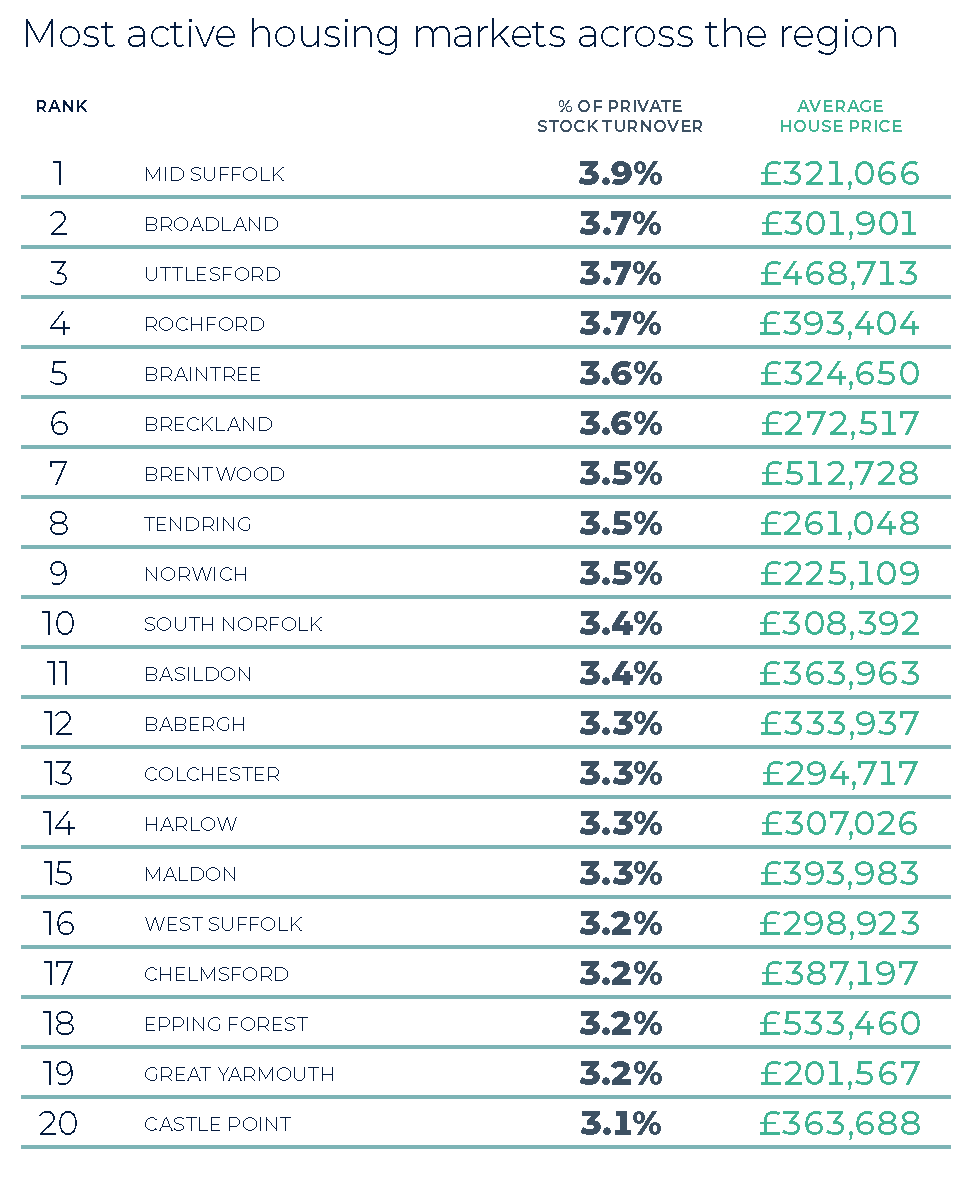

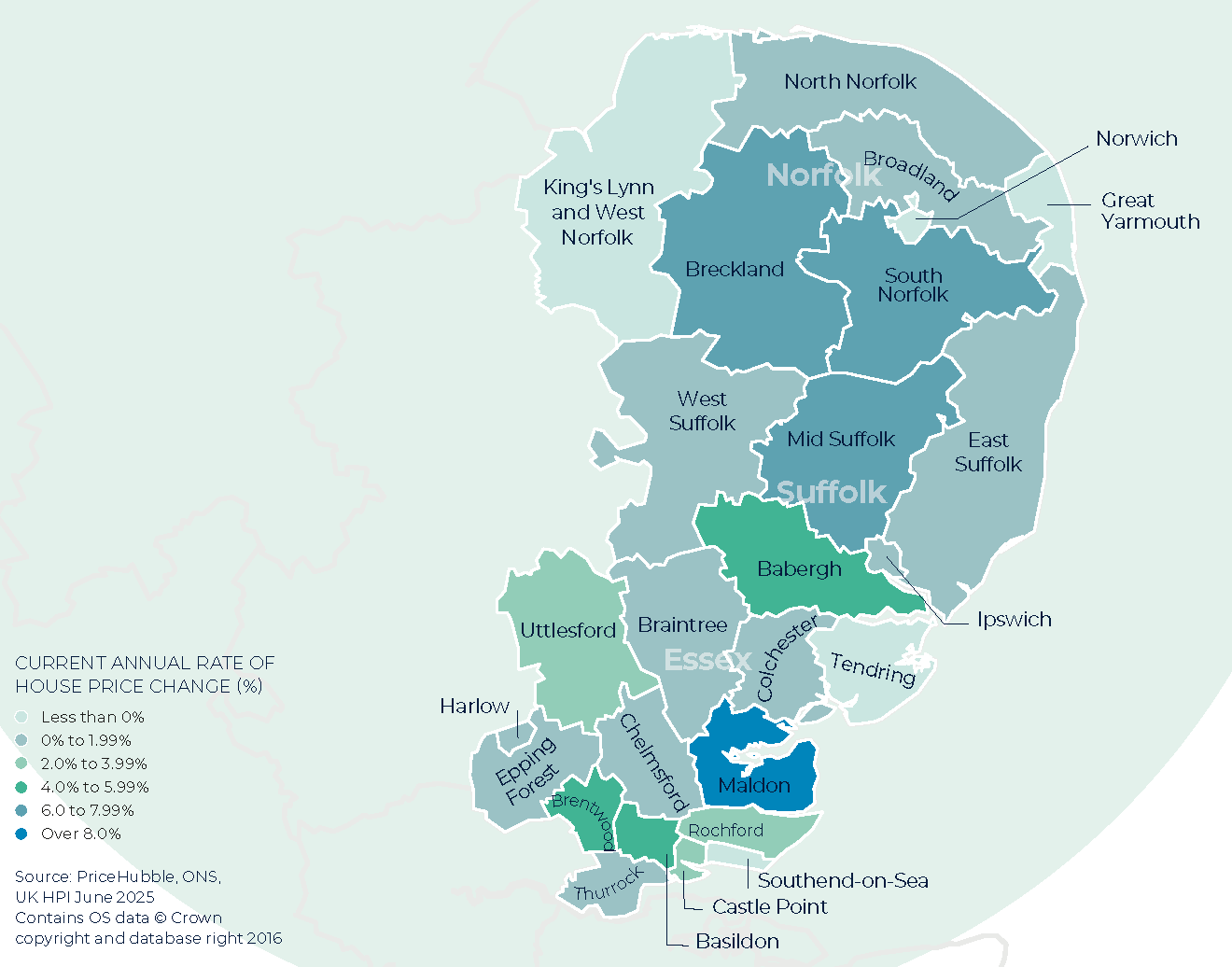

Average asking prices slipped 1.3% this month to £368,740, matching the typical July–August dip seen over the past five years¹. All regions saw declines except Wales, where prices held firm. While many sellers are pricing sensibly, 34% of homes have still seen reductions — a figure only higher at this point of the year in 2023. With high levels of buyer choice, pricing realistically is crucial to securing a sale, with the average time to find a buyer now 62 days. Homes without a price cut sell in just 32 days, compared with 99 days for those that do¹. Pricing at the local level remains distinct from national trends, influenced by a range of localised factors. Average property values in the East of England have risen by 3.7% compared to last year. The sharpest price increase was seen in Maldon, where values climbed by more than 8%.

¹ Rightmove

Lettings: moderating growth rates

After two years of unusually strong gains, the pace of rental growth is slowing. RICS data shows that demand has normalised, pointing to a return to more typical medium-term trends. There are also early signs of improving supply, with Rightmove reporting 15% more homes available to rent than a year ago². Despite an improving balance between supply and demand, competition remains strong, with 45% of agents reporting that there are typically 6–10 applicants per listing and a further 35% reporting 11–20³. The average rent in August was £1,328, 0.2% higher than a year earlier¹.

¹ HomeLet, ²Rightmove, ³PriceHubble, Poll of Subscribers

Contact us

Sell your property with your local expert this season. Contact your local Guild Member today.

Winter 2025 UK Property Market Report: Underlying Resilience

Regional Property Market Update Winter 2025: Wales

Regional Property Market Update Winter 2025: Northern Ireland

Regional Property Market Update Winter 2025: South East Home Counties, Kent and East Sussex

Neville & Neville Estate Agents

London Office

121 Park Lane

Mayfair

London

W1K 7AG

London Mayfair:

0203 0965353

Neville & Neville Estate Agents

East Sussex Office

Forge Meadow, Hammer Lane

Cowbeech, East Sussex

BN27 4JL

East Sussex:

01323 833630

contact@nevilleandneville.co.uk

LONDON OFFICES

WE HAVE THE BUYERS YOU NEED!

NATIONAL & INTERNATIONAL MARKETING